The Harshad Mehta Bull Run: Rajkotupdates.news

Unveiling the Enigma of the Rajkot Stock Market Boom

- Riding the Financial Waves of the ’90s

In the financial history of India, the name Harshad Mehta is synonymous with intrigue, wealth, and controversy. His meteoric rise in the stock market during the early ’90s led to a phenomenon known as rajkotupdates.news harshad mehta bull run, and its ripples reached even the far corners of the country, including the small city of Rajkot. In this article, we will dive deep into the captivating story of the Harshad Mehta Bull Run and its impact on Rajkot.

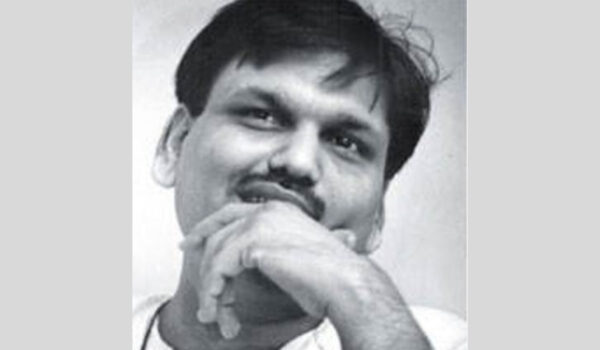

The Rise of Harshad Mehta

- From a Common Man to a Stock Market Sensation

Harshad Mehta, a former stockbroker, became a household name in India due to his astonishing ability to manipulate the stock market. Starting as an ordinary middle-class individual, he rose to prominence with his uncanny understanding of the Indian financial system.

The Bull Run Begins

- Unprecedented Surge in Stock Prices

The Harshad Mehta Bull Run took off when Mehta, often referred to as the “Big Bull,” started buying shares of various companies with borrowed funds, artificially inflating their prices. This led to a massive surge in the stock market, drawing in both seasoned investors and newcomers.

The Impact on Rajkot

- A Whirlwind of Excitement and Confusion

Rajkot, a city in Gujarat known for its vibrant culture and commerce, was not immune to the euphoria created by the Bull Run. Local investors flocked to the stock market, hoping to make quick fortunes. The stock exchanges in Rajkot experienced an unprecedented influx of traders, reflecting the nationwide craze.

Bursting Bubbles

- The Downfall of the Bull

However, as the saying goes, “What goes up, must come down.” The Harshad Mehta Bull Run eventually met its demise when the irregularities in Mehta’s financial dealings came to light. This led to a sudden crash in the stock market, leaving many investors in Rajkot and across India in financial ruins.

The Aftermath

- Lessons Learned and Reforms Initiated

In the wake of the Harshad Mehta scandal, the Indian government implemented various financial reforms to prevent such manipulations in the future. The Securities and Exchange Board of India (SEBI) was strengthened, and regulations became more stringent to safeguard the interests of investors.

Rajkot’s Recovery

- Resilience and Rebuilding

After the stock market crash, Rajkot’s investors faced a challenging period of recovery. Many learned valuable lessons about the importance of due diligence and diversification in investment. Slowly but steadily, the city’s financial landscape started to stabilize.

Conclusion

- Remembering the Harshad Mehta Bull Run

The Harshad Mehta Bull Run remains an unforgettable chapter in India’s financial history. It serves as a cautionary tale about the perils of blindly following market trends and the importance of regulatory oversight. Rajkot, like the rest of the country, learned valuable lessons from this tumultuous period.

FAQs

- What caused the Harshad Mehta Bull Run to begin?

The Bull Run started when Harshad Mehta manipulated stock prices by buying shares with borrowed funds, leading to a surge in the market.

- How did Rajkot’s stock market fare during the Bull Run?

Rajkot’s stock market experienced a frenzy of activity as local investors joined the nationwide excitement, only to face the crash later.

- What were the consequences of the Harshad Mehta scandal?

The scandal prompted significant financial reforms and strengthened regulatory bodies like SEBI to prevent future manipulations.

- Did Rajkot’s investors recover from the crash?

Yes, over time, Rajkot’s investors rebuilt their portfolios and learned important lessons about responsible investing.

- What is the enduring lesson from the Harshad Mehta Bull Run?

The Bull Run serves as a reminder of the risks in speculative investing and the importance of regulatory oversight in financial markets.